- # Returns simulated assuming 12% annual return.

- Mutual fund investments are subject to market risks. Read all scheme related documents carefully.

- Trusave Fintech Pvt Ltd is a registered mutual fund distributor with ARN 321640.

Partnered with India's Top AMCs

Invest with confidence through trusted partners

Why 10 Lakh+ Indians Trust Us

Security, transparency, and performance at every step

Join thousands of smart investors building wealth daily

Start Saving in 3 Easy Steps

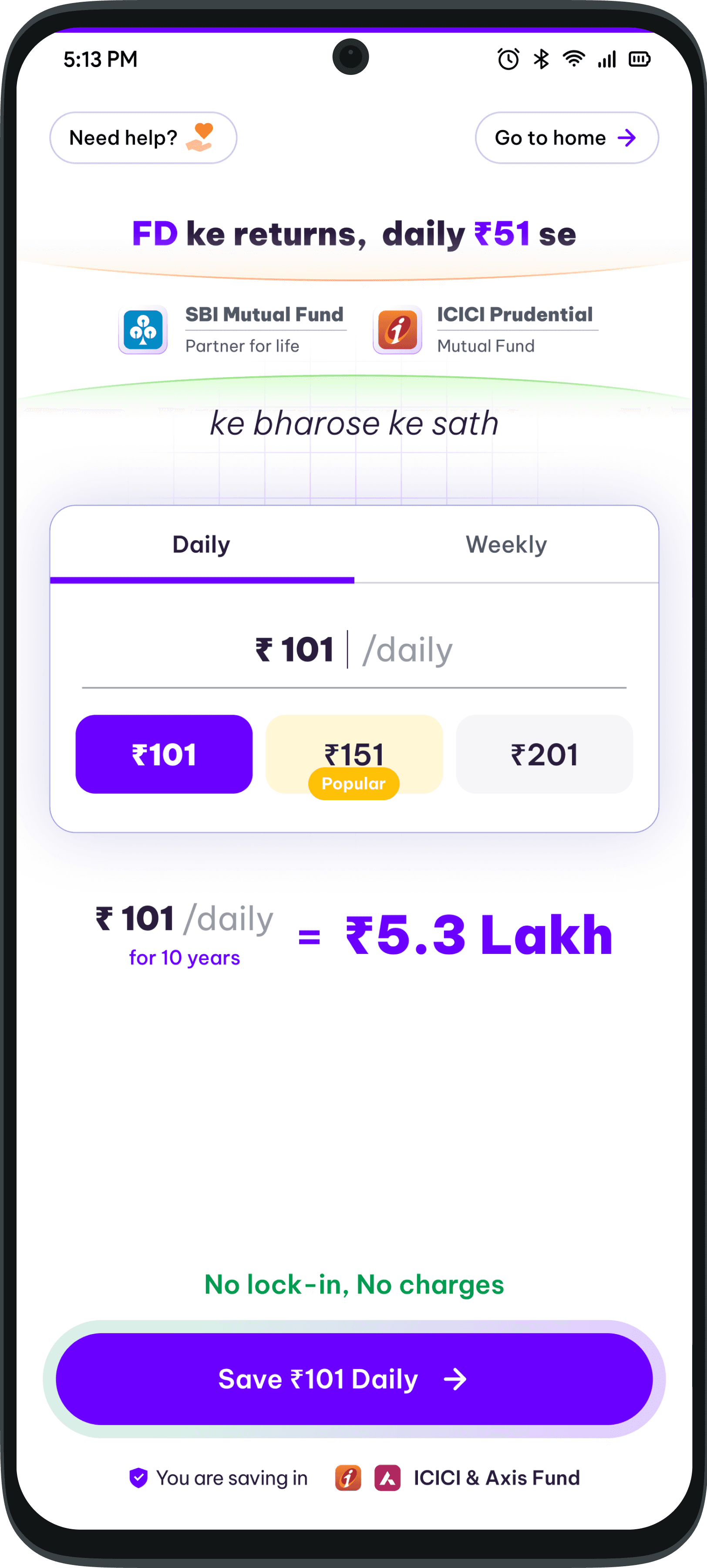

Set Your Daily Amount

No lock-in, fully flexible

Start from as low as ₹51 and increase anytime.

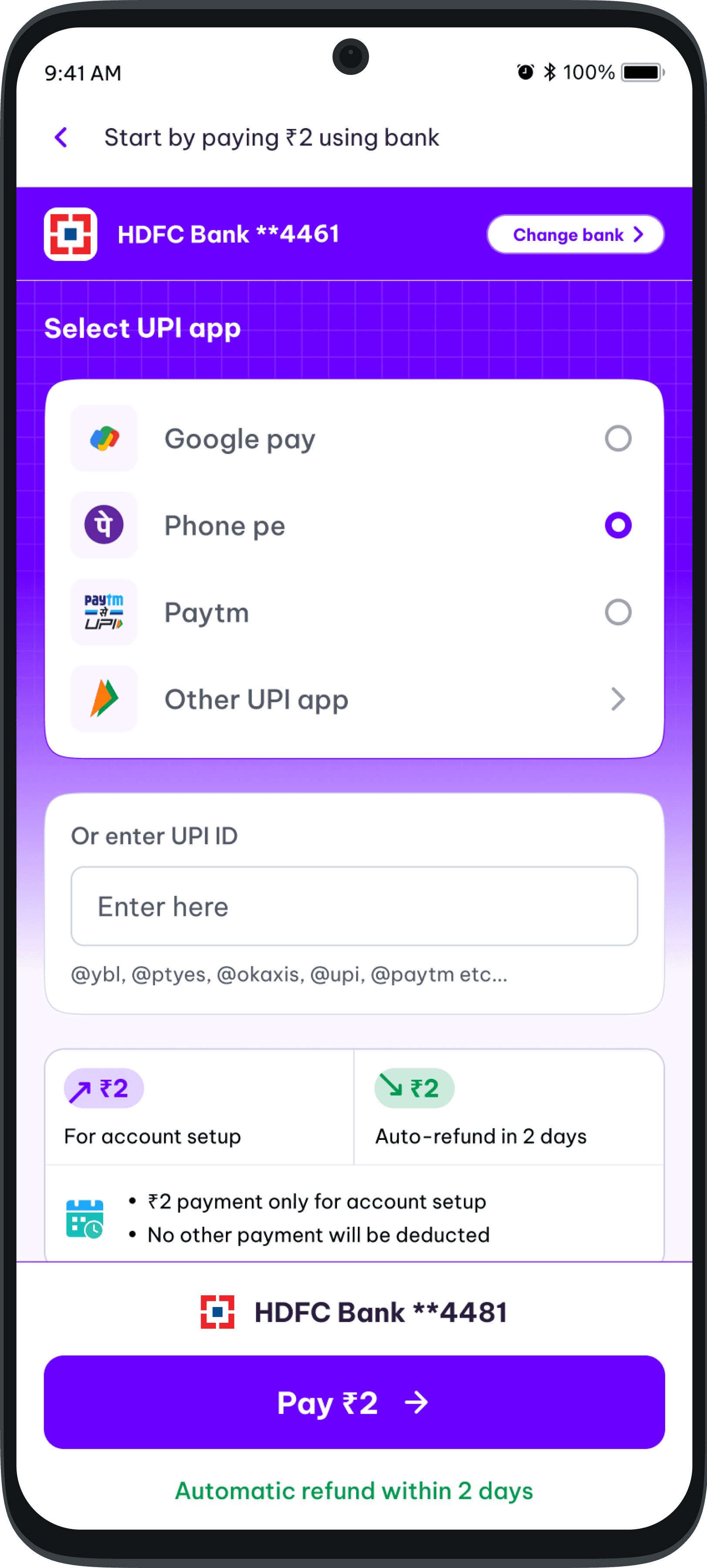

Set up UPI autopay

Autopay with UPI

Setup daily savings with your preferred UPI app.

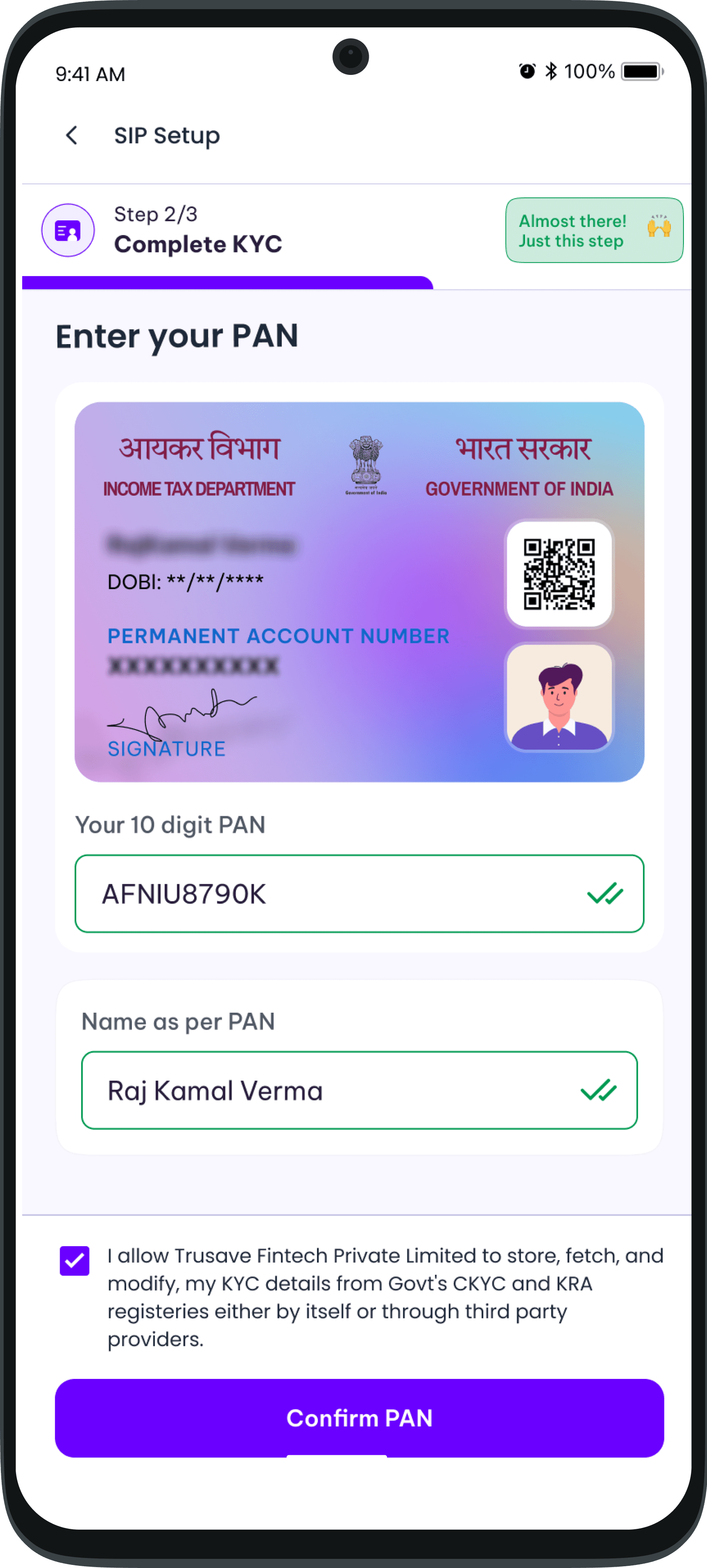

Complete 2 min KYC

Complete your KYC with PAN & Aadhaar

Investments start after KYC completion. It’s quick and easy!

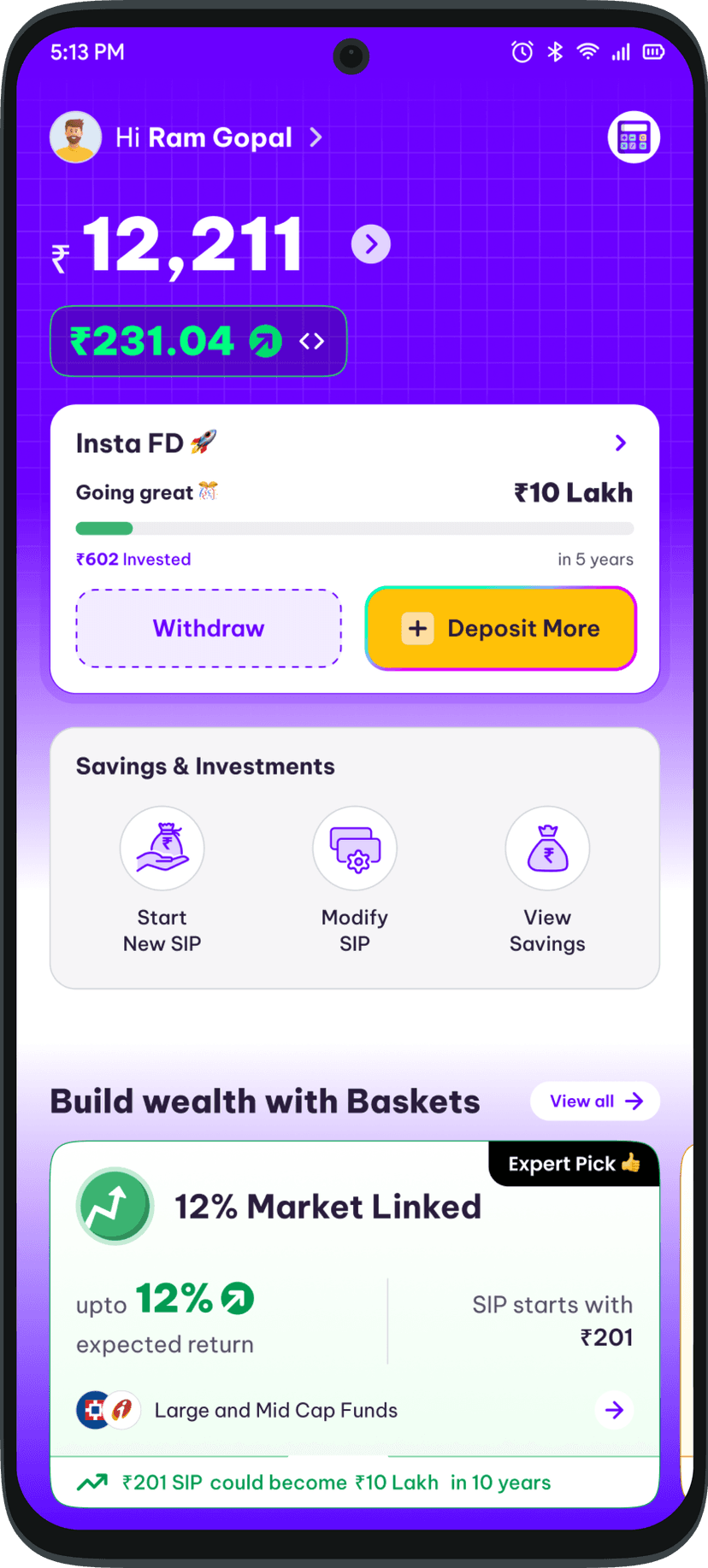

Calculate your wealth with Bachatt

Potential value of investment after 10 Years

India Wealth Growth Journey

Visualize your financial future with compound growth patterns observed in Indian markets

18% of GDP

Avg Household Savings Rate

RBI 2023 Report184% CAGR

Digital Savings Growth

NPCI 2024Bank Deposits (65%)

Top Saving Instrument

NSSO Survey₹2.5Cr Average Target

Retirement Savings Goal

PFRDA StudyWhat our customers say

Leading CEOs/CXOs support Bachatt

Abhinav Sinha

Global COO, OYO

Maninder Gulati

CSO, OYO

Abhiraj Bhal

CEO, Urban Company

Sunil Prabhune

Ex-CEO, L&T FS Rural Finance

Our Founding Team

10+ years of deep expertise in financial services, product & tech, and building and scaling large businesses

Trusted by Leading Institutions

How We Compare to Traditional Options

See why thousands are switching to Bachatt for their daily savings needs

| Features | BEST CHOICE B Bachatt | Traditional Banks | Other Apps |

|---|---|---|---|

Minimum Investment | ₹10/day | ₹500-5000 | ₹100/day |

Expected Returns | 10-15% p.a. | 3-7% p.a. | 10-15% p.a. |

Automation | Fully Automatic | Manual | Semi-Automatic |

Lock-in Period | None | 1-5 years | None |

Withdrawal | Anytime (T+2) | After maturity | Anytime (T+3) |

KYC Process | 5 minutes | 2-3 days | 15-30 mins |

Portfolio Tracking | Real-time | Quarterly | Daily |

Customer Support | 24/7 Chat | Branch only | Email only |

Your Money is Completely Safe

We follow industry-leading security practices to ensure your investments are protected

SEBI Registered

Registered mutual fund distributor with ARN-321640

Bank-Grade Encryption

256-bit SSL encryption protects all your data

Direct AMC Investment

Your money goes directly to AMCs, not stored with us

Complete Transparency

Real-time portfolio tracking with full disclosure

How Your Money Flows

You

Set daily amount

Bachatt

Processes securely

AMCs

Direct investment

We don't hold your money

Goes directly to SEBI-registered AMCs

Encrypted transactions

Same security as your bank

SEBI regulated

Full compliance & transparency

Trusted and certified by

How can we help you?

Browse through our frequently asked questions or search for specific topics

1. बचत ऐप के माध्यम से SBI और ICICI के प्रमुख फंड्स में daily या weekly SIP शुरू कर सकते हैं। 2. daily SIP ₹51 से और weekly SIP ₹1001 से शुरू हो जाती है। 3. पेमेंट के लिए आप UPI mandate सेटअप कर सकते हैं, जिस से रोज़ाना या साप्ताहिक, जैसा आपने चुनाव किया है, राशि अपने आप आपके बैंक खाते से कट कर आपके बचत खाते में जमा हो जाएगी。 4. SIP करने के लिए आपकी अपने PAN और Aadhaar के माध्यम से आसान KYC करने की जरूरत है, जो बचत ऐप में ही 1 से 2 मिनट में हो जाएगी。 5. इस बचत पर आपको सालाना 7% से 8% तक ब्याज मिलता है, जो बैंक की एफडी के बराबर है। 6. बचत ऐप पर कोई लॉक-इन नहीं है — आप ज़रूरत पड़ने पर कभी भी अपने पैसे निकाल सकते हैं। 7. जितने दिन आपके पैसे बचत खाते में रहेंगे, उतने दिनों का डेली ब्याज आपको मिलता रहेगा।

1. मुबारक हो, आपकी SIP शुरू हो गई है। 2. ICICI ने आपका अकाउंट खोलने की प्रक्रिया शुरू कर दी है। 3. अगले 1 se 2 दिनों में आपका अकाउंट क्रिएट हो जाएगा, जिसके बाद आप चाहें, तो पैसे withdraw कर सकते हैं। 4. अकाउंट खुलते ही, ICICI के द्वारा आपको SMS और Email पर इसकी सूचना दे दी जाएगी。 5. सरकार के निर्देश अनुसार, कल आपकी SIP नहीं कटेगी, उसके बाद ये रोज़ाना अपने आप कटने लगेगी。 6. शनिवार और रविवार को SIP नहीं कट ती है, क्यूंकि इन दिनों ICICI बंद रहता है। 7. अपने savings की जानकारी, आप भारत सरकार की वेबसाइट, MF Central पर भी देख सकते हैं। 8. किसी और जानकारी के लिए, आप हमे बचत ऐप के अकाउंट सेक्शन में, हेल्प एंड सपोर्ट के माध्यम से संपर्क कर सकते हैं。 9. बचत के साथ जुड़ने के लिए आपका धन्यवाद।

1. बचत ऐप पर आपकी SIP की पहली राशि कटने के साथ ही, ICICI आपका अकाउंट, यानी की फोलियो क्रिएट करने की प्रक्रिया को शुरू कर देता है। 2. अगले 1 se 2 दिनों में आपका अकाउंट क्रिएट हो जाएगा, जिसके बाद आप चाहें, तो पैसे withdraw कर सकते हैं। 3. अकाउंट खुलते ही, ICICI के द्वारा आपको SMS और Email पर इसकी सूचना दे दी जाएगी।

Ready to Start YourWealth Journey?

Join 10L+ Indians who are building their financial future with just ₹100 a day

10L+

Active Users

₹50Cr+

Invested

4.6★

User Rating

Trusted by investors from